Have you ever needed to borrow money for something important, like buying a house, or a car, or starting a small business, but had trouble getting a loan from a bank?

Or, have you ever wanted to invest your money and earn a higher return 2x / 3x than what you get from a savings account or a traditional investment option like stocks or bonds?

If so, you may want to consider Peer-to-Peer (P2P) lending, a new way to borrow and invest.

In this article, we will discuss this new concept of P2P borrowing and lending, how it works, and its pros and cons. Plus, we’ll also tell you about what peer-to-peer lending, and a few P2P service-providing apps available in 2023.

Let’s get on to it!

What is Peer to Peer Lending?

Peer-to-peer lending also known as P2P lending – is a way of borrowing and lending money online between (two or more) people/individuals online, without involving traditional banks or financial institutions.

Say, it’s an alternative to traditional methods of credit and lending, as it enables individuals to obtain loans directly from another individual, cutting out the financial institution as the middleman.

Instead of borrowing money from a bank, you (the borrower) can borrow money from other people who are willing to lend it to you through a P2P lending platform. These platforms connect borrowers with lenders/investors who are looking for investment opportunities or say who are looking to invest their money in the form of loans.

How Does Peer to Peer Lending Work?

Peer-to-peer lending is a straightforward process. All the transactions are carried out through a specialized online platform that matches lenders with potential borrowers. Here the steps below describe a normal P2P process:

- A potential borrower interested in obtaining a loan completes an online application on the peer-to-peer P2P lending platform and applies for a loan.

- The platform assesses their application and their creditworthiness and then sets an appropriate interest rate.

- Investors then decide whether to fund the loan or not, based on the interest rate and other information about the borrower.

- When the application is approved, the applicant receives the available options from the investors based on their credit rating and assigned interest rates.

- Once the loan is funded, the borrower makes regular payments to the platform, which are then distributed to the investors.

The online platform charges a fee for both borrowers and investors for the provided services.

Read More: How to Create a Budget That Works for You?

Advantages and Disadvantages of Peer to Peer Lending

Benefits of P2P Lending

P2P lending can be a great option for people who have difficulty getting loans from traditional banks, or for investors who are looking for higher returns than they can get from traditional investments. Here are some of the benefits of P2P lending:

i). Easy Access to Loans for Borrowers

P2P lending provides access to loans for people who may not be able to get them from traditional banks due to a lack of credit history or a low credit score.

ii). Higher Returns for Investors

Investors can earn higher returns by investing in P2P loans compared to traditional investment options like stocks or bonds. The returns vary depending on the borrower’s creditworthiness and the interest rate set by the platform.

iii). Diversification of Investment Portfolios

Investors can diversify their investment portfolio by investing in P2P loans, which can reduce the risk of their investment losses.

Risks of P2P Lending

Like any investment, there’s always risk involved, and, P2P lending also carries risks that borrowers and investors need to be aware of. Here are some of the risks of P2P lending:

i). Risk of Borrower Default and Loan Loss

Peer-to-peer loans are exposed to high credit risks. There is always a risk that borrowers might default on their loans, which can result in a loss for investors.

ii). Lack of Regulatory Oversight/Protection

P2P lending is not as regulated as traditional banking systems, which means there may be less protection for borrowers and investors. The government does not provide insurance or any form of protection to the lenders in case the borrower defaults.

iii). Higher Interest Rates for Borrowers

Borrowers may face higher interest rates on P2P loans compared to traditional bank loans due to the higher risk associated with P2P lending.

Things To Consider to Opt for Peer-to-Peer Lending

If you’re considering borrowing or investing through a P2P lending platform, here are some tips to help you get started:

For Borrowers:

- Know your credit score and history. P2P lending platforms use this information to determine your interest rate and whether you’re eligible for a loan.

- Shop around. Compare interest rates and fees from multiple P2P lending platforms to find the best deal for you.

- Read the fine print. Make sure you understand the terms and conditions of the loan before you apply.

- Be honest. Don’t exaggerate your income or assets on your application, as this could result in a loan you can’t afford to repay.

- Make your payments on time. Late payments can hurt your credit score and make it more difficult to borrow in the future.

For Investors:

- Start small. Diversify your investment portfolio by investing in several loans with smaller amounts.

- Understand the risks. Know that there is a risk of default and loan loss, and be prepared to lose some or all of your investment.

- Do your research. Research the borrower’s creditworthiness and other factors before investing in a loan.

- Monitor your investments. Keep track of your investments and make sure you’re receiving the payments you’re owed.

- Consider a managed fund. If you’re not comfortable managing your own P2P lending investments, consider investing in a managed fund that does the work for you.

Peer to Peer Lending for Investors

As an investor, P2P lending can offer several benefits as an investment opportunity. First, it provides a higher rate of return than many other investment options, such as savings accounts or FDs. Additionally, P2P lending allows investors to diversify their portfolios by investing in multiple loans with smaller amounts, spreading the risk across a range of borrowers.

However, P2P lending also carries risks, including the risk of default and loan loss. Investors should do their due research to choose a reputable P2P lending platform, and carefully review the terms and conditions of each loan before investing. Additionally, investors should monitor their investments closely and be prepared to lose some or all of their investments.

P2P Lending Platforms

There are several P2P lending platforms available, each with its own features and benefits. Some of the most popular platforms include Lenme, LendingClub, Prosper, and Upstart.

Before choosing a platform, borrowers and investors should research and compare the different platforms to find the one that best meets their needs.

Best Peer to Peer Lending Platforms

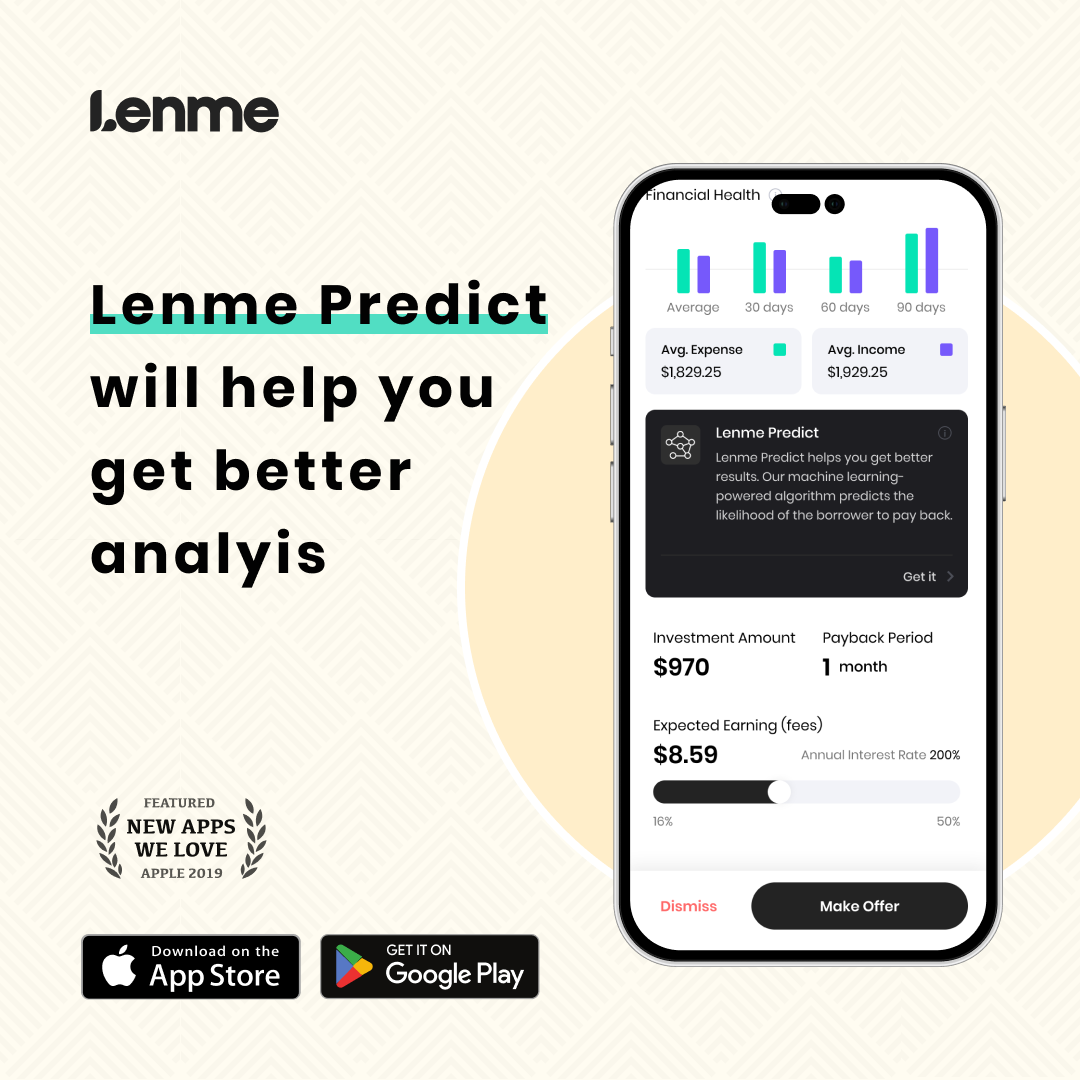

1. Lenme

Lenme is a peer-to-peer lending platform that helps connect borrowers with financial institutions, lending businesses, and individuals so that they can get the money they need all via an app.

Category

• Financial Services

• Business/Investing

• General Loan Services

• Peer-To-Peer Lending

How does Lenme work?

- Have access to lenders competing for your loan within 3 clicks.

- Have access to the types of loan requests within 3 clicks.

- Loan duration can be 1 month up to 12 months with monthly Installments.

- Upon loan agreement, funds will be deposited within 1-2 business days.

2. Upstart

Upstart is an online lending platform that partners with banks to provide personal loans from $1,000-$50,000. They use artificial intelligence and machine learning algorithms to help borrowers find personal loans even if they have limited credit history or other unique circumstances.

Category

• Debt Settlement

• Financial

• Loan Services

Why choose Upstart for your online Personal Loan?

- You can get a personal loan from $1,000 to $50,000.

- You can choose between personal loans in 3 or 5-year terms, with fixed interest rates.

- You can prepay your loan at any time with no fee or penalty.

3. WorldRemit

WorldRemit has transformed the way people send money to their family and friends. As a fast and secure online service, the company helps people to stay connected – no matter the distance between them.

Category

• Debt Settlement

• Financial

• Loan Services

Why choose WorldRemit for your online Personal Loan?

- Sending money is so easy and fast.

- WorldRemit is an authorized and regulated money transfer service.

- Trusted by millions – Over 5 million customers trust them to transfer money to their friends and family worldwide.

Conclusion

In conclusion, P2P lending can be a great way to borrow or invest money, but it’s important to understand the risks involved and do your research before making any decisions. By following these tips and choosing a reputable P2P lending platform, you can minimize your risks and potentially reap the benefits of this new and innovative way of borrowing and investing.

FAQs – Peer-to-Peer Lending P2P

1. What is p2p lending?

Peer-to-peer (P2P) lending is a way of borrowing and lending money between people online, without involving traditional banks or financial institutions.

2. Is Peer-to-Peer Lending (P2P) Safe?

Peer-to-peer lending (P2P) has gained popularity as a way for individuals to borrow and lend money. While P2P lending can be a safe and reliable way to borrow or invest money, it is important to understand the risks involved.

P2P lending can be safe if done properly, but it is important to understand the risks involved and make informed decisions.

3. How do I start peer-to-peer lending?

1. Open an account with a P2P lender and pay some money by debit card or direct transfer.

2. Set the interest rate you’d like to receive or agree to one of the rates that are on offer.

3. Lend an amount of money for a fixed period of time – for example, three or five years.

4. What are the Best Peer to Peer Lending Platforms?

Here are the best P2P lending platforms.

1. Lenme

2. Upstart

3. WorldRemit