Are you a real estate investor who needs fast and easy financing? Are you looking to get fast and easy loans for your real estate venture?

If so, you may have heard of New Silver Loans.

New Silver Loans is a fintech company that provides hard money loans to real estate investors. They specialize in fix-and-flip loans but also offer loans for other types of real estate investments, such as rental properties and development projects.

In this blog post, we will take a closer look at the New Silver Loans review and see if they are the right lenders for you. We will discuss the pros and cons of New Silver Loans, compare them to other hard money lenders, and explain how they work. We will also share customer reviews of New Silver Loans.

Whether you are a seasoned real estate investor or just starting out, New Silver Loans may be a good option for you. Read on to learn more about this hard money lender and decide if they are the right fit for your needs.

What is New Silver Loan? New Silver Loans Review

New Silver Loan is a US-based fintech company founded in 2018 that provides fast and easy financing to real estate investors. They specialize in fix-and-flip loans but also offer loans for other types of real estate investments, such as rental properties and development projects. They use software that accelerates, automates, and streamlines loan origination while using data to reduce the risk of loan default.

With New Silver, you can get immediate approval, a term sheet, and proof of funds within 5 minutes, all online without even having to talk to a salesperson.

In addition, New Silver’s complimentary FlipScout software helps real estate investors find their next fix and flip and buy and hold projects.

Loan Types Offered: Fix and Flip Loans, Hard Money Loans, Refinance / Cash Out Loans, Investment Property Loans, New Construction Loans, Bridge Loans

Property Types Covered: Single Family, Multi Family, Residential Apartments

Areas Served: National

New Silver offers loans to real estate investors who want to fix and flip, refinance, do ground up construction or those that have rental property.

Pros & Cons of New Silver Loans

Pros

New Silver Loans offers several advantages over traditional lenders, including:

- Fast and Easy Financing: New Silver Loans can close loans in as little as 5 days.

- Competitive Rates: New Silver Loans’ rates are competitive with other hard money lenders.

- No Upfront Fees: New Silver Loans does not charge any upfront fees.

- Online Application Process: In minutes, you can apply for a New Silver Loans loan online.

Cons

However, New Silver Loans also have some disadvantages, including:

- Higher interest rates than traditional loans: New Silver Loans’ interest rates are higher than traditional loans, such as mortgages.

- Shorter Loan Terms: New Silver Loans’ loan terms are shorter than traditional loans.

- More stringent lending criteria: New Silver Loans have more stringent lending criteria than traditional lenders.

Overall, New Silver Loans is a good option for real estate investors who need fast and easy financing. However, it is important to compare their rates and fees to other hard money lenders before you apply.

How New Silver Loans Work?

New Silver Loans uses a proprietary software platform to automate the loan origination process. This allows them to close loans quickly and efficiently.

To apply for a New Silver Loans loan, you will need to provide the following information:

- Your personal information includes your Name, Address, and Social Security number.

- Information about your real estate investment, such as the property address, purchase price, and estimated renovation costs.

- Your financial information, such as your income, assets, and liabilities.

Once you have submitted your application, New Silver Loans will review your information and decide within 24 hours. If your application is approved, they will send you a loan agreement. Once you sign the loan agreement, the funds will be wired to your account within 5 days.

How To Get Started with New Silver Loan?

To get started with New Silver Loan, the first thing you need to do is Create an Account for Free on their Official Website.

After that, you can choose among their Four Loan Products/Types. Once you decide which one fits your current project goal, click on the Get Approved Online button and start the process.

Types of Loan Products: Loans for Real Estate Investors

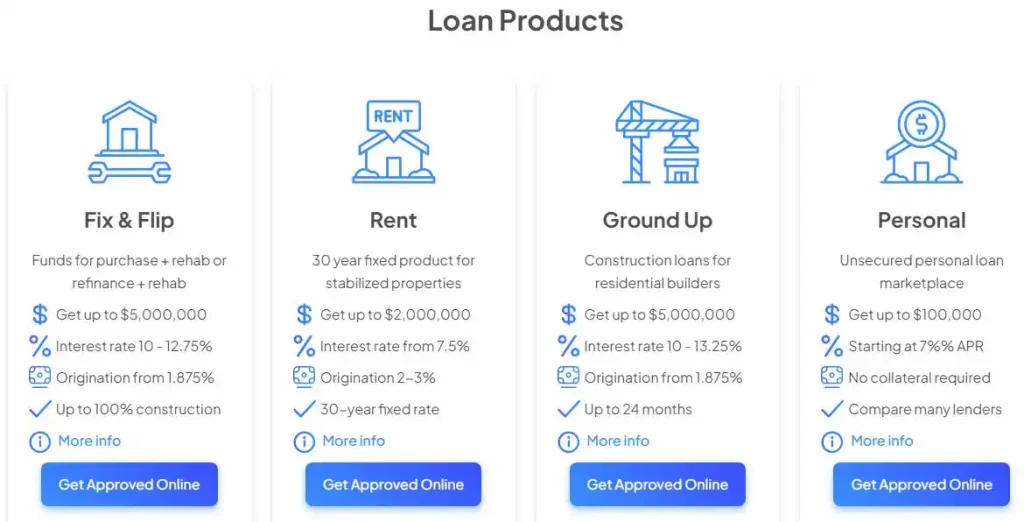

New Silver offers 4 Types of loan products for real estate investors.

- Fix and Flip Loan: New Silver’s Fix and Flip loan is for real estate investors who are into buying or rehab and refinancing properties. The maximum loanable amount is $5,000,000 while the minimum is $100,000. The interest rate is 10-12.75% for a 24-month term with a 1.875% origination fee.

The types of property covered are residential units, townhomes, and condominiums. - Rent Loan: New Silver also offers loans for stabilized properties. This a fixed-rate loan for 30 years and has an interest rate of 7.5%. The maximum loanable amount for this product is $2,000,000 while the minimum amount is $100,000. An origination fee of 2-3% is charged.

The properties covered by this loan are residential and short-term rentals. - Ground Up Loan: Primarily a construction loan, this Ground Up loan is made for residential builders. The maximum loanable amount is $5,000,000 and the minimum is $100,000. The interest rate is relatively high for this one with 10-13.25% for 24 months. The origination fee is 1.75% and the property types required are condos, townhomes, and residential units.

- Personal Loan: Aside from loans for buying real estate, this application and loan platform also provides unsecured Personal Loans. Starting at 7% APR, you can get a personal loan up to $100,000. The loan types are term or line of credit and the origination fee varies. Compared to the other loan products, the approval time is 48 hours.

» RELATED: How to Get a Fast Loan Online with Bad Credit

How Does New Silver Make Money?

New Silver charges investors an annual management fee of 1%. They also charge a performance fee of 20% of any net cash flow after investors receive a 14% preferred return.

However, investors are not charged any upfront fees, but they will be charged a small annual fee and a percentage of any profits they make.

Fast Approval of Loan

Applying for a real estate investment loan from New Silver lending only takes a 5-minute initial time including approval, except for personal loans which can take 48 hours.

You can get immediate approval, a term sheet, and proof of funds within 5 minutes, all online without even having to talk to a salesperson.

Customer Reviews of New Silver Loans

New Silver Loans has received positive reviews from customers. Here are a few examples:

- “New Silver Loans was a lifesaver for me. I needed financing for a fix-and-flip project and they were able to close the loan in just 5 days. Their rates were competitive and their customer service was excellent.” – Hanna Smith (Mar 14, 2022)

- “I was impressed with how easy the application process was with New Silver Loans. I was approved for a loan within 24 hours and the funds were wired to my account within 5 days. I would definitely recommend them to other real estate investors.” – Paul S Forman (Mar 14, 2022)

- I completed my first of several loans. The procedure was fast, clear, and honest. I worked with Alex and he was amazing. I strongly recommend them and I’ve spoken with each lender on the market and New Silver is your ideal. They get your deal done. – Arnyse (Jan 4, 2021)

Conclusion: Is New Silver Worth the Investment?

New Silver Loans is a good option for real estate investors who need fast and easy financing. It is a great hard money lender for new and seasoned real estate investors. However, it is important to compare their rates and fees to other hard money lenders before you apply.

To add more to its benefits, they approve loans online as fast as 5 minutes without wasting time all online, and that too without even having to talk to any person online.

If you are considering using New Silver Loans, I recommend reading their reviews and speaking to a loan officer to learn more about their lending criteria and process.

Call to Action

If you are a real estate investor who needs fast and easy financing, I encourage you to contact New Silver Loans today. They can help you get the funding you need to close your next deal.

FAQs – New Silver For Real Estate Investors

What Is New Silver for Real Estate Investors?

New Silver Loan is an online platform that provides fast and easy financing to real estate investors. They specialize in fix-and-flip loans but also offer loans for other types of real estate investments, such as rental properties and development projects.

How Much Does New Silver Hard Money Loan Cost?

Setting up an account is Free. The Cost of loans varies in terms of interest rate and origination fees. You can get up to $100,000 for a personal loan, $5,000,000 for a ground-up loan, $2,000,000 for a rent loan, and $5,000,000 for a fix and flip loan.