Find The Best Loan For Your Business. SBA Business Loans with Lendio.

Lendio is an award-winning, online loan marketplace created to help small business owners get loans for business.

These small businesses can get connected with various lenders like active banks, credit unions, and other lending sources to help them secure the funds needed to start or expand their business operations.

Lendio Business Loans Overview

Lendio provides a platform for small business owners to get multiple loan options and compare offers to find the best financing solution for their needs.

As an online platform, Lendio simplifies the loan application process by allowing users to complete a single application, which is then shared with multiple lenders in their network. This increases the chances of finding a suitable loan and streamlines the otherwise time-consuming task of applying to individual lenders separately.

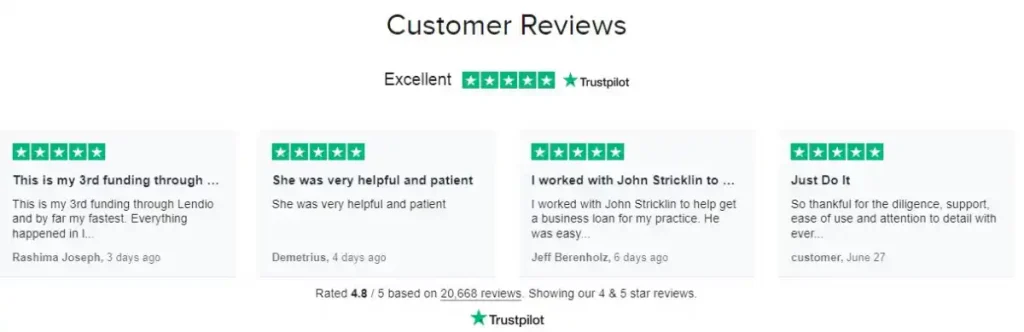

To date, this digital platform has helped fund over 300,000 loans for more than $12 billion and has maintained excellent customer reviews.

With a network of over 75 lenders, Lendio provides clients with the tools they need to manage their money and improve their credit rating.

How It Works? Lendio Business Loans Review

Lendio doesn’t lend money directly itself; rather, it partners with a network of over 75 other lenders to help you get the funding your business needs.

Lendio offers a wide range of loan options, including term loans, equipment financing, lines of credit, business acquisition loans, and more. The platform caters to various business purposes, such as working capital, expansion, inventory purchase, debt consolidation, and even startup funding.

With Lendio’s robust lender network, this highly-rated platform can serve as a strong option for quickly zeroing in on the best lender.

Prospective borrowers can apply for various loans such as startup business loans, short-term loans, equipment financing, etc.

How To Get Started? Lendio Business Loans

To get started, business owners can create an account on Lendio’s website and provide information about their business, financials, and loan requirements.

You can simply get business loans online approval from Lendio.

Lendio’s system uses this data to match applicants with relevant lenders from their network. Once matched, business owners can review loan offers, compare interest rates, terms, and fees, and choose the loan that best fits their needs.

Lendio’s online loan marketplace simplifies the borrowing process for small businesses by offering convenience, transparency, and access to multiple lenders. It serves as a valuable resource for business owners seeking financing options to support their growth and financial objectives.

Who Lendio Is Best For?

Lendio Small Business Loans is typically best for small business owners who:

- Want to be thorough: – With over 75 lenders in its network, you can save a lot of time versus checking with that many lenders individually.

- Aren’t sure what funding option is best: – Lendio can help you choose which of its financing options might work best for your business.

- Want to work with a reputable company: – Lendio has some of the best reviews in the online small business lending world.

Read More: Find The Right Loan to Grow Your Small Business

Who Lendio Isn’t Right For?

Lendio business loans are typically not right for business owners who:

- Value Privacy: – Lender networks like Lendio often give your contact information out to many lenders, so you may see a flurry of phone calls, emails, and mailings.

- Want to thoroughly vet a lender first: – Lendio’s model connects you with specific lenders instead of you doing your own initial research on a group of lenders.

One of the key advantages of Lendio is its wide network of lenders. The platform partners with various financial institutions, including traditional banks, alternative lenders, and online lenders. This extensive network increases the likelihood of finding a suitable loan option, even for businesses with unique financing needs or less-than-perfect credit.

Pros & Cons: Lendio Small Business Loans

Pros

- Available in all states

- Wide range and network of funding options/lenders

- Positive ratings and reviews

- User-friendly experiences

- Offers educational resources & guides to help borrowers make informed decisions

- Efficient and time-saving

Cons

- Does not work with all lenders

- Not much information available for each funding solution

Additionally, Lendio aims to provide a user-friendly experience. The platform features a straightforward and intuitive interface, making it easy for business owners to navigate and understand their loan options.

Lendio also offers educational resources and guidance to help borrowers make informed decisions about their financing choices.

Lendio Loan Requirements

Lenders consider the following requirements when evaluating a potential small business owner for a business loan:

- Credit Score

- Revenue

- Time In Business

- Collateral/Personal Guarantee

- Business Plan

- Financial Documentation

i). Credit Score:

Lenders check your credit score to see if you’ll pay back a loan. It’s based on your history with credit cards, loans, and debts. Business owners need both personal and business scores. Different lenders have different score requirements.

ii). Revenue:

For small businesses to get loans, they need to show they can repay. Lenders compare their income to their debts. New businesses without income struggle to get loans. Sometimes, higher income can make up for a lower credit score.

iii). Time In Business:

Lenders check how long your business has existed. It can be 6 months to 2 years. Some work with new businesses.

iv). Collateral/Personal Guarantee:

Collateral is something valuable to secure a loan. If you can’t pay, the lender takes it. A personal guarantee means you’re responsible if the business can’t pay. Some loans don’t need these but are harder to get.

v). Business Plan With Loan Proposal:

Explain how you’ll use the loan and grow. What’s the plan? How will you pay back? What if things change? Show your team’s skills too.

vi). Industry:

Some lenders avoid risky industries. Certain loans have restrictions. Make sure you fit the lender’s focus.

vii). Financial Documentation:

Lenders need your tax returns, financial statements, bank statements, licenses, and plans. You might be more eligible than you think. Apply and explore your choices.

Lendio Business Loans: Application Process

The application process on Lendio is designed to be efficient and time-saving. After submitting the initial application, borrowers can typically receive multiple loan offers within a matter of days. This speeds up the loan comparison process and enables business owners to quickly secure the necessary funds to support their operations.

How To Apply For An SBA Loan?

Sure, you can go the bank route with a long application process and a 75% rejection rate. But if you’re looking for financing in this lifetime, Lendio offers a faster, easier application process.

Step 1: Fill out the 15-minute online application.

It’s secured with bank-grade encryption and SSL technology, so you know your information is safe.

Step 2: Receive matches.

We pair you with loan options from our network of 75+ lenders. Our dedicated funding managers can help you weigh the pros and cons of each option.

Step 3: Get funded.

Once you’re approved, you’ll be able to access your capital in one to two months.

Lendio Customer Reviews

Lendio helps your small business do more by giving you access to the funds you need, fast. Lendio has funded over 330,000 loans for small businesses across the country.

Read their customer reviews and see what other business owners are saying about Lendio.

Lendio made the loan process a breeze

Lendio made the loan process a breeze for me! I was able to get approved and get funded within 24 hours of accepting the offer! Amazing services! – Breana N (MARCH 06, 2023)

An A+ Experience

I had an awesome experience. The entire process took about 3 days and they actually approved me for exactly what I needed to help my business expand. Everyone was helpful and thorough. I would do it again! – Dinah L (FEBRUARY 13, 2023)

It was easy to get a loan through…

It was easy to get a loan through Lendio. I went to 5 other banks before Lendio. They have been nothing but helpful, they respond quickly, and very knowledgeable about what type of loans are available. Thank you for helping me with my business. Y’all have made my life easier so thank you again. – Heather H (FEBRUARY 21, 2023)

Get Started with >> Lendio Small Business Loans Online Here.

Conclusion

In conclusion, Lendio is an online loan marketplace that helps small businesses access multiple loan options through its extensive network of lenders.

By simplifying the loan search and application process, Lendio business loans aim to empower entrepreneurs and support their financial goals.

FAQs – Lendio Small Business Loans

Is Lendio a legitimate company?

Yes, Lendio is a legitimate business loan and financing platform that provides SBA loans.

Is Lendio good for loans?

Lendio is best for small businesses that aren’t sure what type of financing suits their needs. Because of its large network of lenders, Lendio is able to narrow down potential options to select the right loan for small businesses.

Is Lendio easy to get approved?

Lendio requires a soft credit check before loan approval. Besides that, you’re going to need to provide at least 6 months of bank statements and two years of tax returns.

Does Lendio charge a fee?

Lendio is always free for applying and reviewing your loan options – however, many lenders will charge application fees. It’s a good rule of thumb to ask about potential application fees before starting the process with a lender.

What credit score do you need for Lendio?

Minimum Credit Score By Loan Type

Type | Credit Score Requirement*

Term Loan: Minimums start at 660

Line of Credit: Minimums start at 600

Invoice Factoring: Typically have no credit score requirement

Equipment Financing: Minimums start at 520