Imagine a situation where you are living a life where you have to earn your living, spend for daily needs, and also save for the future.

A Normal Life, isn’t it?

Now, imagine there is a special app, a financial mobile app that helps you to keep track of your spending and also helps you save money. These money-saving apps can make the process of saving money much easier and simpler over time.

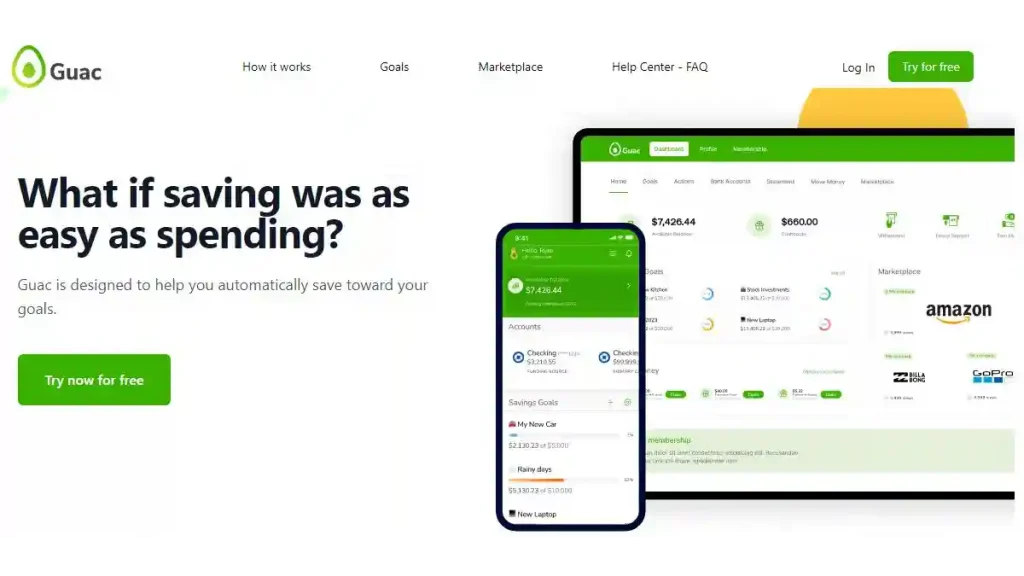

Well, the Guac App is such an app that will help you save money and reach your financial goals faster. These mobile applications are here to revolutionize the way we live our lives.

In this Guac app review, we will dive into the features, benefits, and how to use this app to start saving while spending, offering insights to help you make an informed decision.

Guac App Review: What is the Guac App?

The Guac app is a financial mobile app that helps you save money and reach your financial goals faster.

Say, you have your financial goals as buying “a new car”, “a new house”, “a vacation”, or even “a new iPhone” and you have set your target saving amounts (say $10,00). Also, you have set your target deadline (within 1 Year). And then off you go.

Example: “I want to buy a new car within my next 29th Birthday.”

The Guac app will help you set up a percentage-based savings rule that automatically sets aside and saves a portion of every purchase toward your goals.

Example: You have set up a rule in the app that every time you spend ‘x’ amount on something, the app sets aside 10% of the money spent on your savings.

Say you bought $100 worth of product; it sets aside $10 automatically in your savings.

Guac helps you save money faster

It does this by connecting to your bank account and automatically saving a percentage of your spending. You can also set up specific savings goals, such as a down payment on a house or a new car, and Guac will track your progress and help you stay on track.

By tracking all these goals and processes, you and your subconscious mind will be aware of the target goals.

The Guac app is also unique in that it offers cashback rewards for spending money at participating merchants. This means that you can earn money back on the things you’re already buying, which can help you save even more money.

Overall, the Guac app is a great tool for saving money and reaching your financial goals faster. It is easy to use and offers a variety of features to help you save money, including automatic savings, cashback rewards, and a marketplace where you can shop from a variety of merchants.

Guac is a natural competitor and alternative to Acorns and Wealthfront.

Key Takeaways

- Category: Budgeting

- Known For: Automated Saving Tool

- Description: Guac App is a financial app that helps you save money and reach your financial goals faster.

- Cashback Offers: Guac App offers cash back from its Marketplace.

- Account Minimum: $0 to open an account.

How does the Guac App Work?

Guac App works by saving money on spending.

Guac is designed to help you automatically save toward your goals.

How to start saving money with Guac App?

To start saving money with Guac, first, you have to set up an account and link your bank account(s) to it.

1. Set Your Goals

Afterward, start by setting up your savings goals to reach your goals faster. You can choose what you’re saving for, your target goal amount, your percentage of savings, and when you would like to achieve your goal (deadline).

2. Save while you Spend

Guac recommends saving at least 10% of each purchase, but you can customize the amount based on the goal’s size, deadline, and what you can afford to save from week to week and month to month.

3. Stay on Track with Daily Analytics

Start tracking your progress toward each goal with Guac’s daily analytics toolkit and adjust your savings percentage accordingly.

4. Achieve Your Goal

When you reach your goal, you can check if it’s available for purchase in the Guac Marketplace. Guac Marketplace includes shops like travel, events (vacations), merchandise (footwear, fashion, beauty products), and more.

You can then earn cash back with no fees from the eligible Guac Marketplace purchases.

How to Use the Guac app?

To use the Guac app, simply sign up for an account and connect your bank account(s).

Once your account is connected, you can start setting up savings goals and enabling automatic savings. You can also start earning cashback rewards by shopping from the Guac marketplace.

Here are the steps on how to use the Guac app:

- Sign up for an account: You can create an account on the Guac website or in the mobile app.

- Connect your bank account(s): Once you have an account, you will need to connect your bank account(s) so that Guac can track your spending and automatically save money for you.

- Set up your savings goals: You can set up specific savings goals, such as a down payment on a house, a new car, or a new iPhone. Guac will track your progress and help you stay on track.

- Enable automatic savings: You can enable automatic savings so that Guac will automatically save a percentage of your spending. This is a great way to save money without even having to think about it.

- Earn cashback rewards: You can earn cashback rewards by shopping from the Guac marketplace. Guac has partnered with a variety of merchants where you can earn money back on your purchases.

Guac Marketplace

You will find a variety of categories of shops in Guac Marketplace such as:

- Fashion and apparel

- Footwear

- Beauty products

- Automotive products

- Events (like concerts and festivals)

- Travel (yes, you can book travel through Guac’s partners)

You’ll find these well-known brands (among others) in the Guac Marketplace:

- Sephora

- Bloomingdales

- Puma

- Alaska Airlines

- Southwest Airlines

- Marriott

- IHG (the hospitality family)

- Jimmy Choo

- Cole Haan

- Saks Off 5th

And you can earn cash back on eligible purchases here, with no fees. Just use your linked payment card or bank account to complete the purchase.

Key Features of the Guac App

The Guac app offers a variety of features to help you save money and reach your financial goals, including:

- Goal-based savings: Set up specific savings goals, such as saving for a down payment on a house or a new car, a long-awaited vacation, or a new phone, and Guac will track your progress and help you stay on track.

- Automatic savings: Guac will automatically save a percentage of your spending, so you don’t even have to think about it.

- Cashback rewards: Earn money back on the things you’re already buying at participating merchants.

- Marketplace: Shop from a variety of merchants and earn cashback rewards on your purchases.

Benefits of Guac App

The Guac app offers a number of benefits, including:

- Save money faster and easier: Guac makes it easy to save money, even if you don’t have a lot of extra income. The automatic savings feature and cashback rewards can help you save even more money without even having to think about it.

- Reach your financial goals sooner: By setting up specific savings goals and using Guac to track your progress, you can reach your financial goals sooner.

- Earn rewards for spending money: Guac’s cashback rewards program gives you the opportunity to earn money back on the things you’re already buying. This is a great way to save even more money without having to change your spending habits.

- Shop from a variety of merchants: Guac’s marketplace gives you access to a variety of merchants where you can earn cashback rewards on your purchases. This is a great way to save money on everything from groceries to clothes to travel.

Pros and Cons of the Guac App

Pros:

- Easy to use; User-friendly interface

- No hidden fees

- Free version of App Available

- 1 Month Free Trial of Premium

- Effective for saving money

- Cashback rewards with numerous brands

- Marketplace for shopping

- Highly secured with FDIC insurance (up to $250,000)

Cons:

- No interest on savings balances

- Limited selection of merchants in the marketplace

Who is Guac App For?

The Guac app is a great option for anyone who is looking to save money and reach their financial goals faster. It is especially good for people who:

- Are new to saving money and need a little help to get started.

- Want to save money automatically without having to think about it.

- Want to earn cashback rewards on their purchases.

- Are looking for a simple and easy-to-use savings app.

Who should not use the Guac app?

The Guac app is not a good option for people who:

- Are looking for a savings account that offers interest.

- Need a savings app with a wide selection of merchants in its marketplace.

- Have complex financial needs.

Is the Guac app worth it?

Yes, the Guac app is worth it. It is a free app to use and it offers a number of features that can help you save money and reach your financial goals faster.

One of the best things about the Guac app is that it is very easy to use. You simply sign up for an account and connect your bank account(s). Once your account is connected, you can start setting up savings goals and enabling automatic savings. You can also start earning cashback rewards by shopping from the Guac marketplace.

Alternatives to the Guac App

There are a number of alternatives to the Guac app, including:

- Acorns

- Digit

- Qapital

- Chime

- Ally

These apps all offer similar features to the Guac app, such as automatic savings, cashback rewards, and goal-based savings. However, each app has its own unique features and benefits.

I encourage you to compare the different apps to find the one that is best for your needs.

Guac app vs. Acorns: Is Guac better than Acorns?

Two of the most popular savings apps are the Guac app and Acorns. Both apps offer similar features, such as automatic savings, cashback rewards, and goal-based savings. However, there are a few key differences between the two apps.

The Guac app is completely free to use, while Acorns has a monthly fee. However, Acorns does offer a student discount and a family plan.

Another key difference between the two apps is the way they invest your money. The Guac app does not invest your money, while Acorns invests your money in a portfolio of ETFs.

Overall, the Guac app is a better option for people who are looking for a simple and easy-to-use savings app that is completely free to use. Acorns is a better option for people who are looking for a savings app that invests their money in a portfolio of ETFs.

Conclusion: Is the Guac App worth it?

Overall, the Guac app is a great tool for saving money and reaching your financial goals faster. It is easy to use, effective and offers a variety of features to help you save money. If you are looking for a way to save money and reach your financial goals, I recommend checking out the Guac app.

FAQs – Guac App Review

Is the Guac app legit?

Yes, the Guac app is 100% legit. GUAC is secured with FDIC insurance (up to $250,000).

Is the Guac app safe?

Yes, the Guac app is safe. It uses bank-level security to protect your financial information.

How do I earn cashback rewards with the Guac app?

To earn cashback rewards with the Guac app, simply shop from the Guac marketplace. You will earn cashback rewards on every purchase you make from a participating merchant.

How do I withdraw money from my Guac savings account?

To withdraw money from your Guac savings account, simply log in to your account and select the “Withdraw” option. You can withdraw money to your bank account or to a debit card.

Why is Guac taking money out of my account?

Guac is only transferring money to save as per the rules you set when you created the Guac Saving fund. Guac does not charge any money.