Using credit cards for making purchases is a common practice these days. While using credit cards one normally gets some incentives such as cashback or rewards. Nowadays these rewards can be in the form of cash or cryptocurrencies as well.

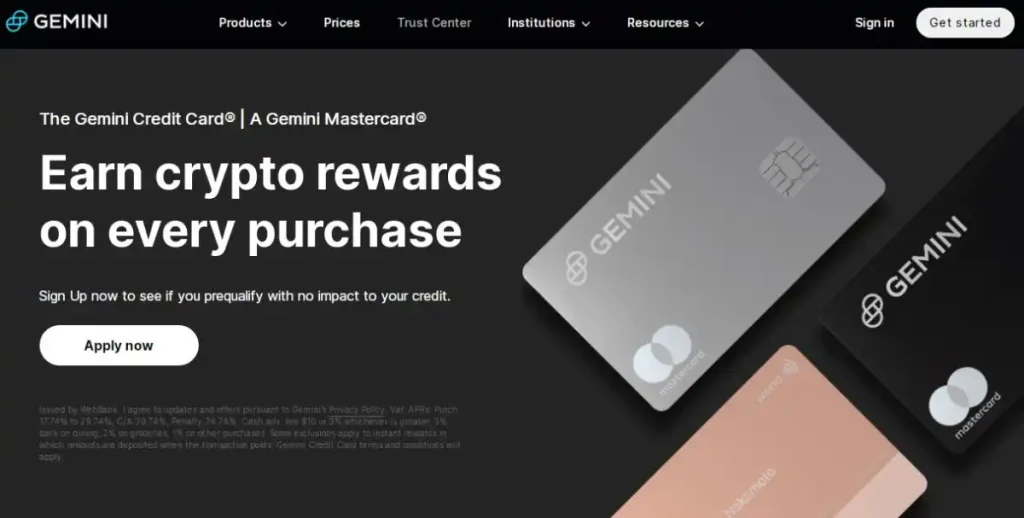

With the advent of cryptocurrencies, many exchanges have come up with credit cards that allow users to earn rewards in cryptocurrencies. One such credit card is the Gemini Credit Card; it makes it much easier to earn rewards on your purchases that instantly turn into cryptocurrency.

In this article, we will explore the pros and cons of using the Gemini Credit Card and help you make an informed decision.

What is Gemini Credit Card?

Gemini Credit Card is a credit card offered by Gemini, a cryptocurrency exchange and custodian. The Gemini Credit Card allows users to earn rewards in the form of Bitcoin, Ethereum, and 40+ other cryptocurrencies on all their purchases.

The card is issued by WebBank, a Utah-chartered industrial bank, and is available in all U.S. states and territories.

It’s the only credit card that deposits your crypto rewards immediately. That means the crypto you earn lands in your Gemini account the instant you swipe, not a month later.

Key Points: Gemini Credit Card

What Problem Does it Solve?

Lots of people are using credit cards for purchases, like dining outside, groceries, online shopping, and many more. And lots of them are missing out on possible cashback offers and rewards.

Even if they got it, it takes them months to redeem those. Also, they charge certain fees on the transaction.

How does Gemini Credit Card Solve the Problem?

Gemini Credit Card acts as an alternative as it outbenefits them by:

- No Annual Fees, No foreign transaction fees, and No exchange fees to acquire your crypto rewards.

- Instant rewards the moment you swipe the card

- Earning crypto on every purchase

Who is this Product for – Target Audiences?

- Frequent online spenders with Credit Cards

- Crypto Currency Enthusiasts: If you are a crypto enthusiast, you will definitely like the Gemini Platform and this credit card.

How does Gemini Credit Card work?

The Gemini Credit Card offers rewards of up to 3% back in real-time in Bitcoin or any other cryptocurrencies that you can exchange on Gemini’s platform. The ability to earn cryptocurrency directly and in real-time as opposed to earning cash back that is converted to crypto sets the Gemini Credit Card apart.

Gemini states that you will earn

- 3% back on dining (on up to $6,000 in annual spending; then 1%),

- 2% back on groceries, and

- 1% back on all other purchases

in any cryptocurrency that can be traded on Gemini’s platform. That means you’re not limited to Bitcoin, you could also earn Ethereum or even some of the smaller, upstart cryptocurrencies. Also, there are no annual fees, and the card offers perks such as purchase protection and fraud monitoring.

Users can also track their rewards in real-time through the Gemini app. Unlike other crypto rewards-earning cards, your rewards are earned in real-time, meaning you will hold the crypto immediately after your qualifying purchases.

How to Apply for the Gemini Credit Card?

To apply for the Gemini Credit Card, users must have a Gemini account and undergo a credit check. Usually, a credit score of Good/Excellent (670-850) of credit range is required for the approval by the issue but does not guarantee the approval. Also, the user must be a resident of any US state.

Your account verification begins with signing up for a Gemini account, where you’ll have to upload a valid driver’s license or passport. Normally, the account verification decision is done within 24 hours, and once you’re verified, you’ll be able to apply for the credit card.

If approved, you’ll be able to choose between three card colors — black, silver, or rose. You’ll also get instant access to a virtual card after approval, so you can start making transactions as soon as you’re approved while you wait for the physical card to arrive.

You can use the Gemini Credit Card anywhere in the world where Mastercard is accepted, and there are no foreign transaction fees.

Note: Gemini Credit Card Credit Score:- Good/Excellent (670-850)

➢➢ CLICK HERE TO APPLY FOR THE GEMINI CREDIT CARD ➢➢

Choose Your Rewards in Cryptocurrency

You can earn rewards in over 40+ cryptocurrencies. Some of the most popular are listed as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Filecoin (FIL)

- Zcash (ZEC)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Tezos (XTZ)

You can change your crypto rewards type at any time through your online account. You will start earning the new cryptocurrency immediately on your next transactions, and there is no limit as to how many times you can change your cryptocurrency choice.

What can you do with the crypto you earn?

There are no exchange fees to acquire your rewards. You’ll receive your rewards immediately when the transaction occurs. The credit card company claims that it doesn’t make you wait a month for your crypto rewards so you can benefit from any crypto price appreciation the moment you swipe.

When you receive your rewards, they reside on the Gemini Exchange. But you can sell them for USD, trade them for another, or move them to a Gemini Earn account, which functions like a savings account.

Alternatively, Gemini enables users to move their crypto to their own wallets. A crypto wallet offers extra security for your holdings, putting you in control of your crypto rather than an exchange.

Pros & Cons of Gemini Credit Card

Pros

The Gemini Credit Card has several advantages that make it appealing to users.

- Allows users to accumulate cryptocurrency without having to actively purchase it on an exchange, which can be time-consuming and potentially complex for some users.

- Offers a simple way for users to diversify their investment portfolio and potentially benefit from the potential long-term growth of cryptocurrency.

- Ability to earn cryptocurrency rewards on all purchases. Unlike traditional credit cards that offer cashback or travel points, the Gemini Credit Card rewards users with Bitcoin and other cryptocurrencies.

- Offers a user-friendly interface through the Gemini app, where users can track their rewards in real-time.

- Allows users to view their rewards balance, transaction history, and other important information related to their card.

- Additionally, the Gemini Credit Card offers the same protection and monitoring features as traditional credit cards, such as purchase protection and fraud monitoring.

Cons

While the Gemini Credit Card offers several advantages, it also has potential drawbacks that users should be aware of.

- Rewards are only available in cryptocurrency, which may not be desirable for users who prefer to receive rewards in other forms such as cash or travel points.

- Rewards rate of up to 3% is competitive compared to other credit cards, but it may not be as high as some cashback rewards offered by traditional credit cards.

- Potential risk of cryptocurrency volatility and potential loss of value. While earning rewards in Bitcoin or other cryptocurrencies can be appealing, their values can fluctuate rapidly and unpredictably.

Therefore, it’s important to have a solid understanding of cryptocurrency and its risks before using the Gemini Credit Card.

Factors to consider before applying for the Gemini Credit Card

Before applying for the Gemini Credit Card, users should consider several factors to ensure it aligns with their financial goals and needs.

- Firstly, users should evaluate their comfort level with cryptocurrency and their understanding of the potential risks associated with cryptocurrency investments.

- Secondly, users should consider their financial goals and preferences for rewards. If users prefer cashback or travel rewards, the Gemini Credit Card may not be the best option for them.

Finally, users should evaluate their credit history and ability to manage credit responsibly.

If you decide to apply for the Gemini Credit Card, make sure to read and understand the terms and conditions carefully. Additionally, always monitor your rewards balance and keep track of any changes in cryptocurrency values.

Lastly, remember to use the card responsibly and pay off your balance on time to avoid interest charges and potential damage to your credit score.

Conclusion – Is Gemini the Best Crypto Credit Card?

In conclusion, the Gemini Credit Card can be a good choice for those who are comfortable with cryptocurrency and want to earn rewards in that form. However, like any financial product, it’s important to weigh the potential benefits and risks and make an informed decision based on your individual needs and financial goals.

Gemini Credit Card Features

Rewards

- Up to 3% back on dining, 2% back on groceries, 1% back on all other purchases

- Rewards available in bitcoin, ether, or 40+ other cryptocurrencies

- Change your crypto reward type at any time, as much as you like

- Receive rewards when the transaction occurs

No fees to use your card

- No annual fee

- No foreign transaction fees

- No exchange fees to acquire your rewards

Security

- Crypto rewards are protected by Gemini’s world-class security

- Mastercard Zero Liability Protection on Unauthorized Transactions

- Mastercard ID Theft Protection™

- Instantly lock your card anytime from the Gemini app

- Receive real-time alerts based on transaction size or type

Other Features and Benefits

- Your choice of a black, silver, or rose gold stainless-steel card, made from 75% recycled material

- Access to a digital card

- Available to residents of all 50 U.S. states

- 24/7 Customer Support

- Access to card features and details in the Gemini mobile app

- Exclusive offers with select merchants such as DoorDash, HelloFresh, Lyft, and ShopRunner

FAQs – Gemini Credit Card Review

Can I change my crypto reward type?

Yes. You can change your crypto reward type at any time and it will be reflected on all future transactions. There is no limit to how many times you can change your crypto reward type.

Which cryptocurrencies can I choose from?

You can choose from over 40+ cryptocurrencies available on the Gemini Exchange. The full list can be found here.

What credit score is needed for a Gemini credit card?

To apply for the Gemini Credit Card, users must have a credit score of Good/Excellent (670-850) credit range.

Disclaimer: The investing information provided on this page is for educational purposes only. We do not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities, or other investments.