Compare the best personal loans online for good and bad credit, debt consolidation, home improvement, and many more.

The best type of loans are Personal Loans, Cash Advance Loans, Installment Loans, and Emergency Loans.

We always recommend you know your credit score and compare personal loans from multiple lenders before making a choice.

Apply For Best Personal Loans Online 2023

Here are our picks for the best personal loans online for you to apply for personal loans online :

Compare the Best Personal Loans Online of 2023

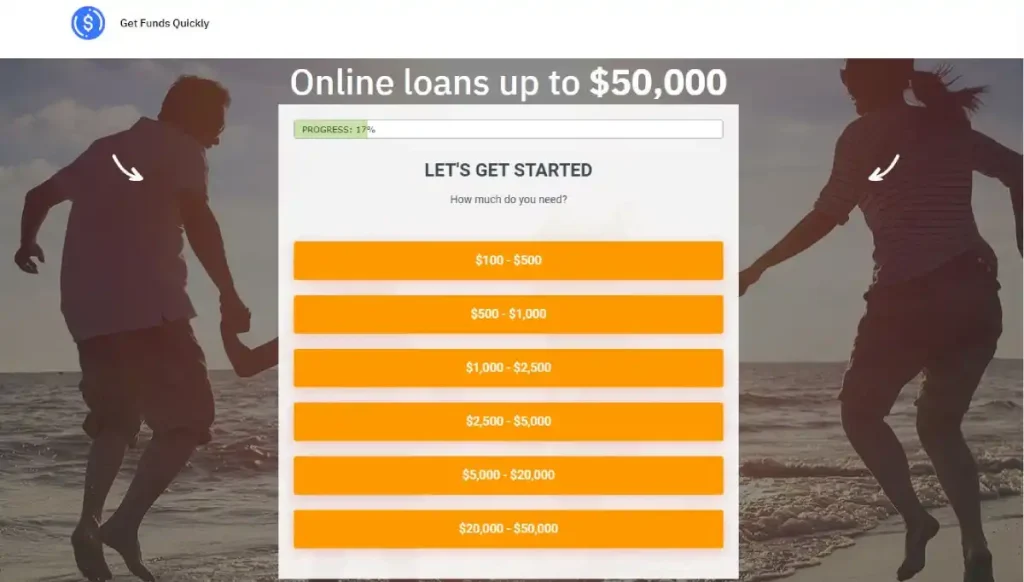

1. Get Funds Quickly

Official Website: https://www.getfundsquickly.com/

2. Upstart

Upstart Personal Loans provide personal loans from $1,000 to $50,000 for credit card refinancing, debt consolidation, large purchases, and much more. After going through our secure and simple online application process, applicants can receive rates in just 2 minutes with funds available the next business day.

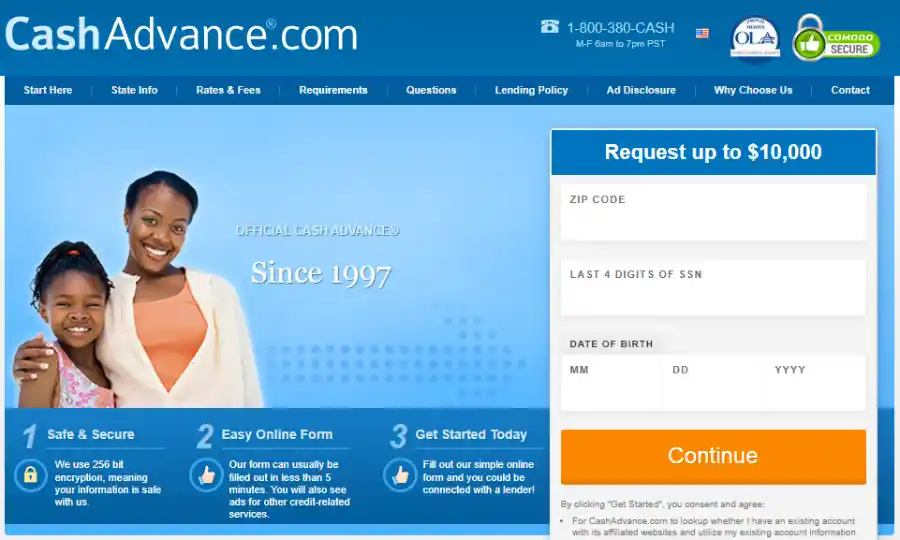

3. CashAdvance.com

If you need money and you need it quickly, that’s where CashAdvance comes in. They provide a free service that aims to quickly connect customers with lenders that offer loans that may work for them.

They also connect you with offers for other credit-related services like debt relief, credit repair, and credit monitoring.

Best Usage of Get Funds Quikcly Loans

- Car Expenses

- Medical Expenses

- Utility Bills

- Rent

What is a Personal Loan?

A personal loan is an amount of money you can borrow to use for a variety of purposes, such as debt consolidation, home improvement, a dream wedding, vacation, or unexpected expenses. They are often used to cover larger expenses that may be difficult to pay for out of pocket.

Personal loans are generally offered by banks, credit unions, or online lenders. The money you borrow must be repaid over time, typically with interest. Some lenders may also charge fees for personal loans.

Personal loans typically have fixed interest rates and repayment terms generally from 6% to 36%, making them a predictable and manageable way to borrow money. The loan with the lowest rate is the least expensive — and usually the best choice.

However, it’s important to carefully consider the terms and conditions of the loan, including the interest rate, fees, and repayment schedule, before applying for a personal loan.

Read More: How to Get a Personal Loan with Bad Credit

Here are some of the personal loan key features:

- Secured and Unsecured Loans: Personal loans can be secured, meaning you need collateral to borrow money, or unsecured, meaning no collateral is needed. Collateral can be a home or car or any other property.

- Fixed interest rate: Personal loans typically have a fixed interest rate, which means that the interest rate won’t change over the life of the loan.

- Fixed repayment term: Personal loans also usually have a fixed repayment term, meaning that the borrower will know exactly how long it will take to repay the loan and how much they need to pay each month.

- Fixed monthly payment: With a personal loan, the borrower will typically have a fixed monthly payment, which can make budgeting and managing finances easier.

- Versatile: Personal loans can be used for a variety of purposes, including debt consolidation, home improvement, or unexpected expenses.

- Credit check: Most lenders will perform a credit check before approving a personal loan, and a good credit score can help borrowers qualify for better rates and terms.

- Fees: Personal loans may come with fees, such as an origination fee or prepayment penalty, so it’s important to read the terms and conditions carefully before applying for a loan.

Factors to consider for choosing the best Personal Loan Lenders.

- Interest rates: Compare the interest rates offered by different lenders to find the best rate for your credit score and financial situation.

- Fees: Look for lenders with low or no fees, such as origination fees or prepayment penalties.

- Repayment terms: Consider the length of the loan repayment term and whether it fits your budget and financial goals.

- Loan amounts: Make sure the lender offers loan amounts that meet your borrowing needs.

- Customer service: Look for lenders with good customer service and support.

- Reputation: Check online reviews and ratings for lenders to get a sense of their reputation and customer satisfaction.

Remember to always read the terms and conditions carefully before applying for a loan, and to only borrow what you can afford to repay.