Your credit score is a three-digit number that represents your creditworthiness – that is, how likely you are to pay back a loan.

Simple Steps to Boost Your Credit Score

Before getting into a way to boost your credit score quickly, let’s get to know more about your credit score and how to improve credit score.

Understanding Credit Score

It is an important factor that lenders, landlords, and even some employers consider when making decisions about you.

A high credit score can open doors to financial opportunities, such as being approved for a mortgage or getting a lower interest rate on a loan. It can also affect getting a mortgage, renting an apartment, and even getting a job.

On the other hand, a low credit score can be a roadblock to these opportunities and may even result in higher costs and fees. That’s why it’s important to understand and know how your credit score is calculated and take steps to improve it.

In this article, we’ll explore credit score improvement techniques and how you can apply them to improve yours.

How to Improve Your Credit Score?

You can improve your credit score and build a strong credit history by following these simple steps:

- Checking your Credit Report and Score

- Understanding and improving your credit utilization ratio

- Making Timely Payments

- Dispute any errors on your credit report

- Consider a Credit Repair Service

Good Credit Opens Doors To The Things You Want Most.

1. Check your Credit Report and Score

The first step in improving your credit score is to understand what’s in your credit report.

Your credit report is a record of your credit history, including information about your credit accounts, loans, and payment history. It is maintained by three major credit bureaus – Equifax, Experian, and TransUnion – and can be accessed for free once a year through AnnualCreditReport.com.

You can also get a free copy of your credit report if you’ve been denied credit, insurance, or employment within the past 60 days based on information in your credit report.

In addition to your credit report, you should also check your credit score. Your credit score is a numerical representation of your creditworthiness, based on the information in your credit report. It ranges from 300 to 850, with a higher score indicating a stronger credit profile. Your credit score is not included in your free annual credit report, but you can purchase it from the credit bureaus or through a credit scoring company.

When you review your credit report and score, look for any errors or discrepancies that may be affecting your credit score. This could include incorrect personal information, accounts that don’t belong to you, or errors in your payment history.

If you find any errors, you can dispute them with the credit bureau by submitting a dispute form and providing any supporting documentation. It’s important to act quickly, as it can take time to resolve a dispute, and the sooner it’s resolved, the sooner it can be reflected in your credit score.

2. Understand and Improve your Credit Utilization Ratio

Your credit utilization ratio is a key factor that affects your credit score.

It is the amount of credit you are using compared to the amount of credit available to you, and it is expressed as a percentage. For example, if you have a credit card with a $1,000 limit and you have a balance of $500, your credit utilization ratio is 50%.

A high credit utilization ratio can lower your credit score because it suggests that you are relying heavily on credit and may be at risk of defaulting on your debts.

On the other hand, a low credit utilization ratio can improve your credit score because it indicates that you are managing your credit responsibly.

To improve your credit utilization ratio, you can try the following strategies:

- Pay off your credit card balances: The more you can pay off your balances, the lower your credit utilization ratio will be. Try to pay off as much as you can each month and avoid carrying a balance from month to month.

- Increase your credit limits: If you have a good credit history, you may be able to get an increase in your credit limits, which will lower your credit utilization ratio. Keep in mind that applying for new credit can temporarily lower your credit score, so try to limit the number of credit applications you make.

- Use credit cards responsibly: Avoid maxing out your credit cards or using more than 30% of your available credit. This can help keep your credit utilization ratio low and improve your credit score.

- Consider a balance transfer credit card: A balance transfer credit card may be a good option if you have high balances on multiple credit cards. These credit cards allow you to transfer your balances from other credit cards onto a single card with a lower interest rate. This can help you pay off your balances faster and lower your credit utilization ratio.

3. Make Timely Payments

Making timely payments is another important factor that affects your credit score.

Late or missed payments can harm your credit score. To improve your credit score, it’s important to pay all your bills and debts on time, every time.

Here are some strategies for making timely payments:

- Set up payment reminders: You can use your phone, computer, or calendar to set up payment reminders. This can help you avoid missed payments due to forgetfulness or a busy schedule.

- Automate your payments: Many creditors and lenders offer the option to automate your payments. With this option, your payments will be automatically deducted from your bank account each month, which can help ensure that your payments are always on time.

- Pay more than the minimum: If you have credit card debt, try to pay more than the minimum monthly payment. This can help you pay off your debt faster and improve your credit score.

4. Dispute any Errors on Your Credit Report

If you find errors on your credit report, it’s important to dispute them as soon as possible.

Errors can include incorrect personal information, accounts that don’t belong to you, or errors in your payment history. These errors can hurt your credit score and make it harder for you to get approved for credit.

To dispute an error on your credit report, you’ll need to contact the credit bureau that is reporting the error. You can do this by phone, online, or by mail. When you contact the credit bureau, be sure to provide any supporting documentation that proves the error is incorrect. This can include copies of bills or statements that show the correct information.

It’s important to be patient when disputing errors on your credit report. It can take time to resolve a dispute, and the credit bureau has up to 30 days to investigate your claim. If the error is found to be valid, it will be removed from your credit report.

5. Consider a Credit Repair Service

If you’re having trouble improving your credit score on your own, you may want to consider a credit repair service.

Credit repair services are companies that help you improve your credit score by disputing errors on your credit report, negotiating with creditors, and providing credit education and counseling.

There are many credit repair services to choose from, and it’s important to do your research before selecting one.

Things to Consider when Choosing a Credit Repair Service

Here are a few things to consider when choosing a credit repair service:

- Cost: Credit repair services typically charge a fee for their services. Be sure to compare the costs of different services and consider whether the fee is worth the potential benefit.

- Reputation: Look for a credit repair service with a good reputation. You can check online reviews, ask for recommendations from friends and family, or check with the Better Business Bureau to see if the service has a good track record.

- Effectiveness: Look for a credit repair service that has a proven track record of success. You can ask the service for references or testimonials from satisfied customers, or ask about the success rates of their services.

It’s essential to keep in mind that credit repair services are not quick fixes. It can take time to see results, and there is no guarantee that a credit repair service will be able to improve your credit score.

Additionally, some credit repair services may use tactics that are unethical or even illegal, such as creating false credit histories or using stolen identities. Be sure to choose a reputable credit repair service that follows all the rules and regulations.

Conclusion

Improving your credit score takes time and effort, but it’s worth it. A strong credit score can open doors to financial opportunities and help you save money on loans and other debts. By following the steps outlined in this article, you can take control of your credit and build a strong credit history.

Remember to check your credit report and score regularly, understand and improve your credit utilization ratio, make timely payments, dispute any errors on your credit report, and consider a credit repair service if needed. With persistence and dedication, you can improve your credit score and achieve your financial goals.

Best Credit Repair Services

You can try these best credit repair services for professional help.

1. Credit Sesame

Credit Sesame is a 100% free personal finance credit and debt management tool with no credit card required or trial period.

Credit Sesame makes managing personal credit online, owing less in interest, and saving on mortgage, loan & credit card payments easy!

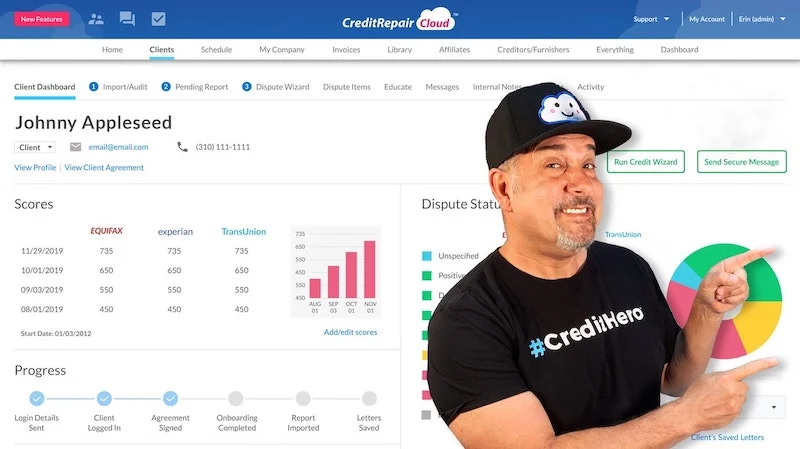

2. CREDIT REPAIR CLOUD

Credit Repair Cloud is the Software You Need to Run and Grow Your Life-Changing Credit Repair Business.

It makes it incredibly easy to run and grow your very own profitable credit repair business, or add an entirely new revenue stream to your existing business.

Try Credit Repair Cloud FREE!

3. The Credit Pros

The Credit Pros, ranked by Inc. Magazine as one of America’s 5,000 fastest-growing companies in 6 years running, is a financial technology firm dedicated to educating our clients on how to avoid credit-oriented mistakes in the future.

They are equally committed to improving the lives of our employees and have been honored by Inc. Magazine as one of the 50 best places to work.

With an A+ BBB Rating and serving the country for more than 13 years.

Get a FREE Consultation here >> The Credit Pros

4. Axion Credit Repair

Axion Credit Repair (ACR) is the leading credit repair firm specializing in providing actual credit repair service, financial literacy, and credit information to consumers online.

This company has been revered as a trusted agent by numerous clients as being the ‘go-to’ credit repair professional services provider.

This program has a 90-day guarantee of you having a 700 credit score or better.

- Money-Back Guarantee if you do not have a 700 FICO or better combined score on all 3-Bureaus.

- Includes removal of Inquiries, Late Payments, Charge Off, Liens, Bankruptcy, Collections, Eviction

- Fee – $ 99.99 / Month

- Flat one-time fee of $1,999.

- Tradeline Supply Company – A credit-building strategy that has benefited primarily the privileged for over 40 years. Tradeline Supply Company, LLC aims to promote equal credit opportunity by making this option available to everyone.

FAQs – How to Improve Your Credit Score?

How can I improve my credit score?

You can improve your credit score by following these simple steps:

· Checking your Credit Report and Score

· Making Timely Payments

· Understanding and improving your credit utilization ratio

· Dispute any errors on your credit report

· Consider a Credit Repair Service

The Invest Freak is not a financial advisor, so it’s best to consult a professional for help repairing your credit.

If you are not familiar with Credit Reporting and Repairing Companies you should try them. They will assist you in fixing your credit report. They will help you in increasing your credit score.